For many car owners, navigating the world of auto insurance policies, coverage needed, and deductibles can be a daunting and frustrating experience. While there are hundreds (if not thousands) of different choices and options to choose from, the right choice often comes down to personal preference and individual needs.

What’s the difference?

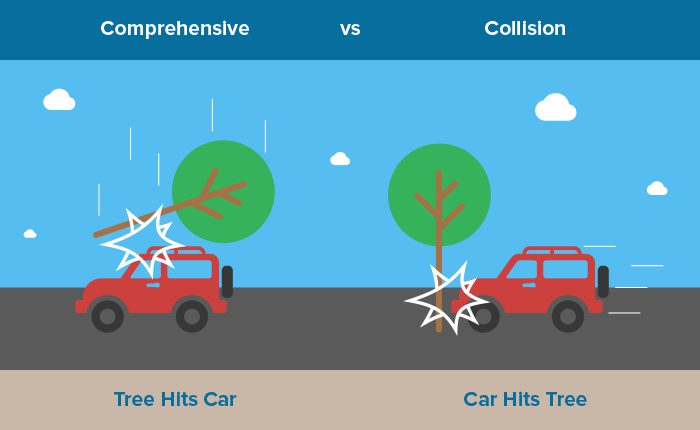

One of the most common questions we get regarding insurance, is ‘what is the difference between collision and comprehensive coverage’? In the most simple terms, collision coverage covers damage that takes place during a collision (duh), and comprehensive policies provide coverage for incidents other than collisions. Most common instances of this would be fire damage, flooding, hail damage, tree branches, etc.

What is covered by comprehensive insurance?

- Fire

- Theft

- Vandalism

- Natural disasters

- Damage done by animals

What does collision insurance cover?

- Collision with another vehicle

- Collision with an object (yes, the moving light pole that came out of nowhere counts)

- A single-car accident that involves rolling or falling over

Want help deciding whether to make a claim? Try out our Claim Calculator to get a recommendation.

What is required by law?

All 50 states have a state minimum requirement for auto insurance, however, that almost entirely consists of bodily injury and property damage liability coverage. They’re just trying to be sure you can pay if you do damage to someone else. But what about your coverage? These minimums leave many additional decisions about your auto insurance coverage in your hands. Collision, ride-sharing, or even sound system coverage are up to the discretion of the owner. While the intricacies of the auto insurance world can be confusing at first, it allows vehicle owners to find a policy that works best for their individual needs.

*Note: Many leasing companies often require comprehensive coverage of their vehicles

This post is designed to help you begin to understand the differences between insurance policies but is not meant to be a substitute for a licensed insurance agent. If you have questions regarding your insurance policy, we highly recommend reaching out and speaking to your agent to further identify your needs and find a policy that works best for you.